In the realm of banking, the need for authorization often arises, particularly when granting permission for specific actions or access to financial information. One common and formal way to convey this permission is through a Authorization Letter to Bank. Also check out our collection of authorization letter to claim.

In this article, we will delve into the intricacies of these letters, understanding their purpose and significance. Additionally, we will provide samples of various authorization letters tailored for different banking scenarios.

Table of Content

- What is a Bank Authorization Letter?

- How do I write a bank authorization letter?

- How to write an authorization letter to allow someone to collect bank statements?

- What is the Purpose of the Authorization Letter for a Bank?

- Sample Authorization Letters

- Recap of the Importance of Bank Authorization Letters

- Final Thoughts on Crafting Effective Authorization Letters

What is a Bank Authorization Letter?

Definition and Purpose

A Bank Authorization Letter is a formal document that empowers an individual or entity to act on behalf of another in financial matters. This letter serves as a legal and official consent for specific banking transactions.

Instances Requiring Bank Authorization Letters

- Loan application processes

- Fund transfers

- Access to account information

- Collection of bank statements, ATM cards, or other banking instruments

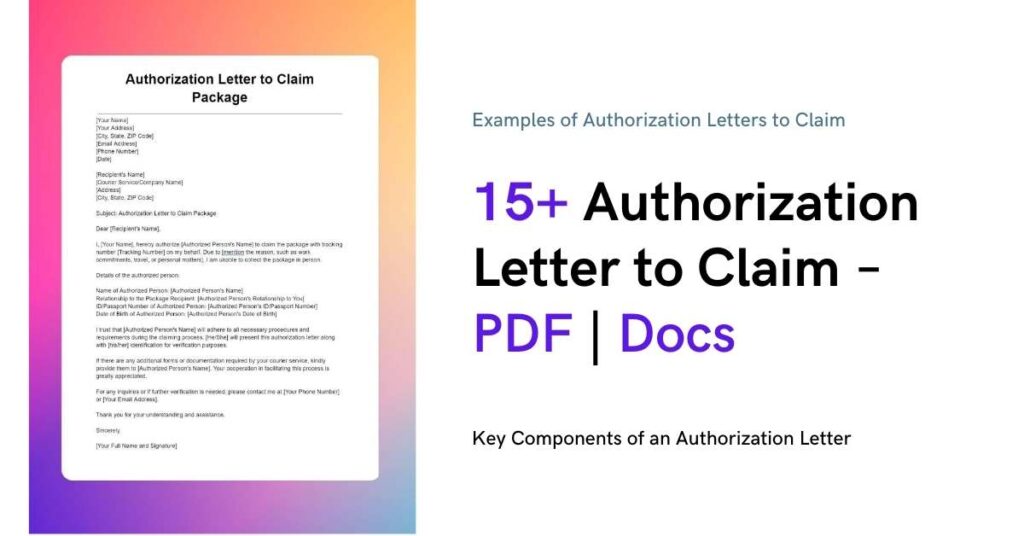

Key Components of a Bank Authorization Letter

When crafting a Bank Authorization Letter, include the following:

- Clear identification of the parties involved

- Detailed description of the authorized actions

- Specific time frame (if applicable)

- Contact information of both parties

- Signatures of all involved parties

Tips for Crafting an Effective Authorization Letter

- Be explicit and concise in stating the purpose.

- Use formal language and a professional tone.

- Double-check details for accuracy.

- Ensure the letter complies with the bank’s requirements.

Importance of Authorization for Bank Statement Collection

In the modern era of stringent privacy regulations and heightened security concerns, obtaining bank statements on behalf of someone else necessitates a formal Authorization Letter. This document serves as a legal testament to the account holder’s explicit permission for another individual to access and collect their bank statements.

Ensures Legal Compliance:

Banking institutions are bound by laws and regulations that protect the confidentiality of account information. An Authorization Letter helps the bank comply with these regulations by verifying the legitimacy of the request.

Enhances Security Measures:

Authorization Letters contribute to the robust security measures adopted by banks. By requiring a written authorization, the bank can confirm the identity of the authorized person and safeguard against unauthorized access to sensitive financial information.

Provides Clear Documentation:

Having a written authorization provides a clear record of the account holder’s consent. This documentation can be crucial in case of any disputes or discrepancies, offering a transparent trail of the authorized action.

Facilitates Smoother Transactions:

Authorization Letters streamline the process of collecting bank statements by eliminating ambiguity. The authorized person can present the letter to the bank, expediting the transaction and avoiding unnecessary delays.

Sample Authorization Letter for Bank Statement Collection

[Your Name]

[Your Address]

[City, State, Zip Code]

[Date]

[Bank Name]

[Bank Address]

[City, State, Zip Code]

Subject: Authorization Letter for Bank Statement Collection

Dear [Bank Manager’s Name],

I, [Your Full Name], am the account holder of savings account [Your Account Number] with [Bank Name]. I hereby authorize [Authorized Person’s Full Name], whose identification details are provided below, to collect my bank statements on my behalf.

Authorized Person’s Details:

- Full Name: [Authorized Person’s Full Name]

- Address: [Authorized Person’s Address]

- Contact Number: [Authorized Person’s Contact Number]

- Identification Type: [Authorized Person’s ID Type, e.g., Passport/Driver’s License]

- Identification Number: [Authorized Person’s ID Number]

- This authorization is valid from [Start Date] to [End Date], during which [Authorized Person’s Full Name] is permitted to collect bank statements pertaining to the aforementioned account.

I understand that this authorization is subject to verification by your bank, and [Authorized Person’s Full Name] may be required to present the original copy of this letter along with their identification for validation.

I appreciate your cooperation in facilitating this process and ensuring that all necessary security measures are adhered to during the collection of my bank statements.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Full Name]

[Your Signature]

What is the Purpose of the Authorization Letter for a Bank?

Legal and Security Aspects

In the realm of banking, the Authorization Letter plays a crucial role in upholding legal compliance and reinforcing security measures. Understanding the legal and security aspects associated with these letters is imperative for both account holders and banking institutions.

Legal Compliance:

Authorization Letters serve as legal documents that validate and formalize specific actions or transactions on behalf of an account holder. By providing a written record of consent, these letters ensure that all involved parties are adhering to legal requirements.

Verification of Identity:

Banks are entrusted with safeguarding sensitive financial information. Authorization Letters help in verifying the identity of individuals seeking access to accounts or performing transactions. This verification process adds an extra layer of security, reducing the risk of unauthorized access.

Confidentiality and Privacy Protection:

Authorization Letters are instrumental in maintaining the confidentiality and privacy of account-related information. They explicitly outline the scope of authorization, ensuring that only designated individuals have access to specific financial details, thereby safeguarding the account holder’s privacy.

Risk Mitigation:

From a legal standpoint, Authorization Letters act as risk mitigation tools. They create a clear understanding between the account holder and the authorized person, reducing the likelihood of misunderstandings, disputes, or unauthorized activities.

Instances Where Authorization Letters are Mandatory

Third-Party Transactions:

Any transaction or activity conducted on behalf of the account holder by a third party requires explicit authorization. This includes withdrawing funds, depositing checks, or managing the account.

Account Management by Someone Other Than the Account Holder:

When an individual or entity, other than the account holder, needs to manage or make decisions regarding the account, an Authorization Letter becomes mandatory. This could include a family member, legal representative, or business associate.

Specific Banking Services Requiring Explicit Permission:

Certain banking services, such as collecting bank statements, applying for loans, or closing an account, necessitate the account holder’s explicit permission. Authorization Letters are mandatory in such instances to validate the legitimacy of the request.

In essence, the purpose of an Authorization Letter in a banking context is to establish a legal framework, ensure compliance with regulations, and enhance security measures. By clearly defining the scope of authorization, these letters contribute to a transparent and accountable financial environment. It is essential for account holders to be aware of the instances where Authorization Letters are mandatory to navigate banking transactions securely and in accordance with legal standards.

Sample Authorization Letters :

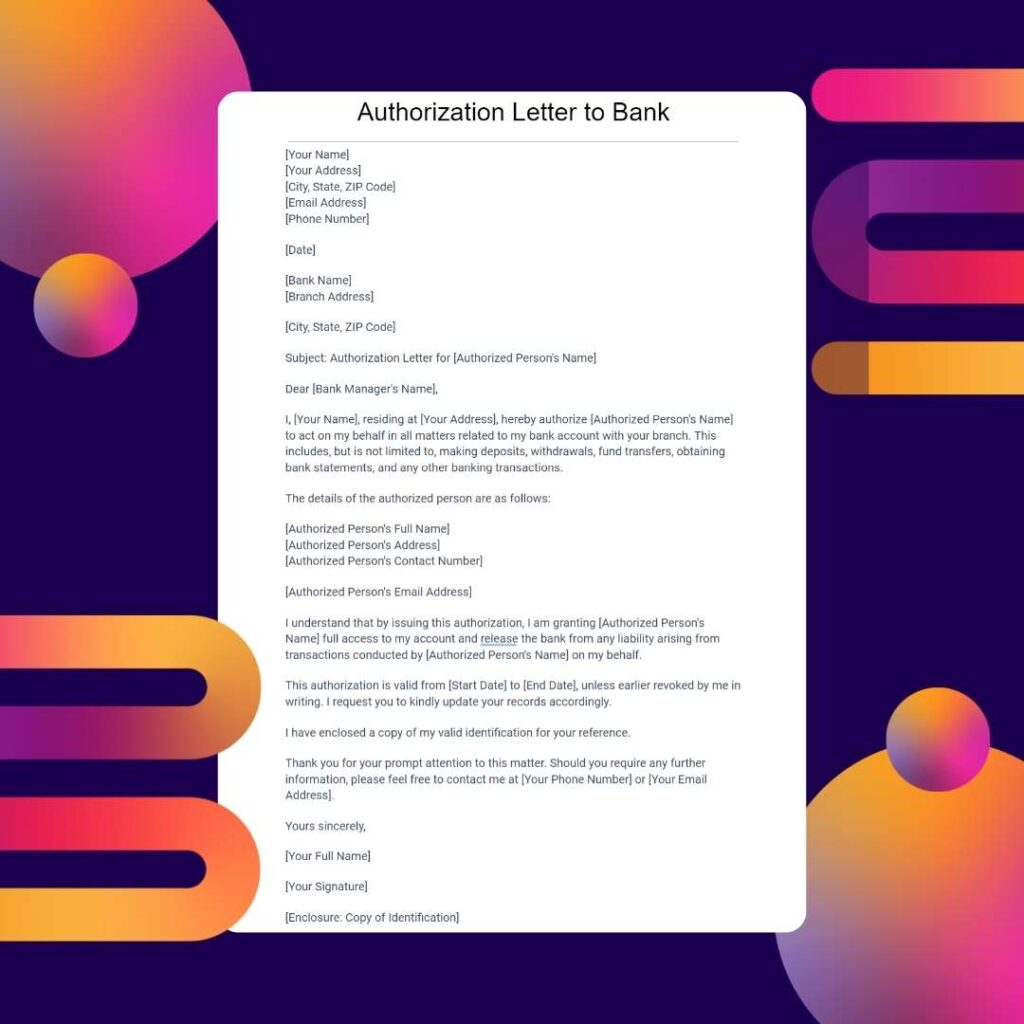

Authorization Letter to Bank

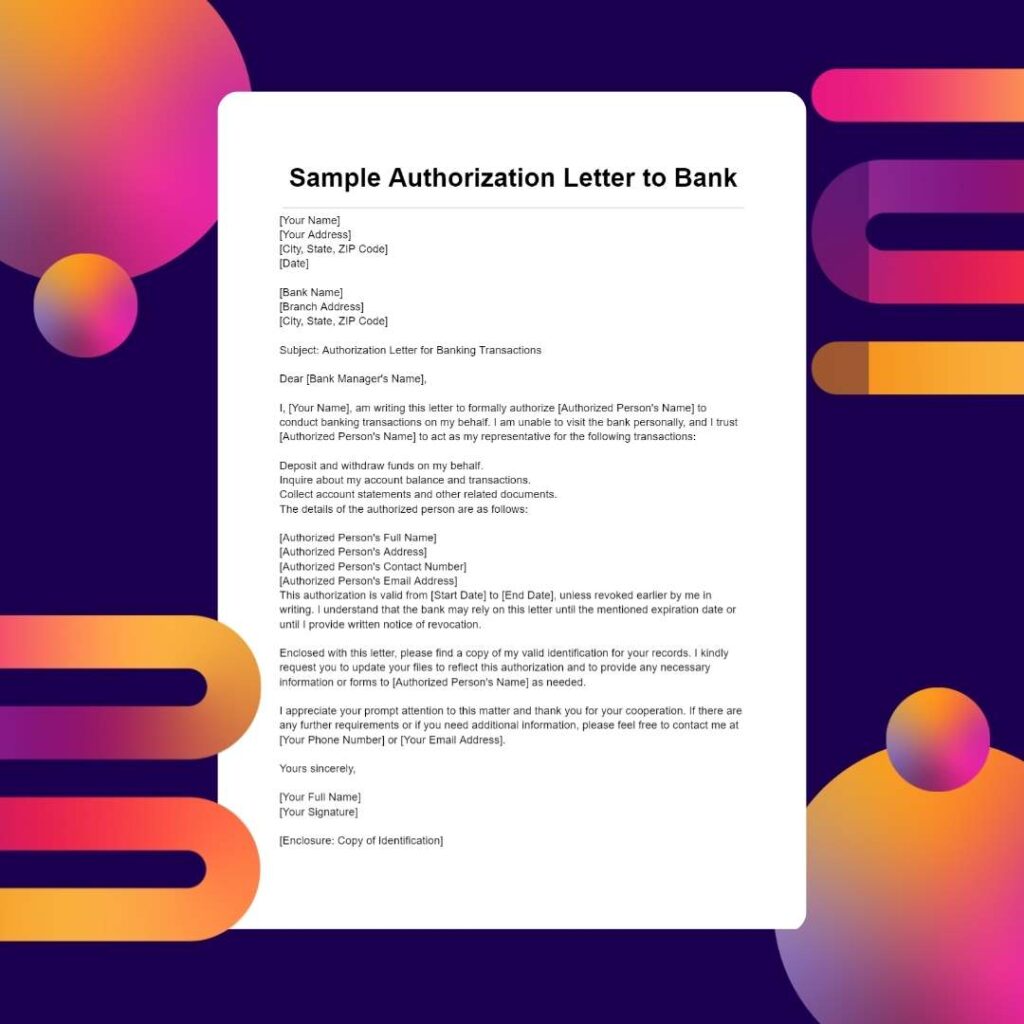

Sample Authorization Letter to Bank

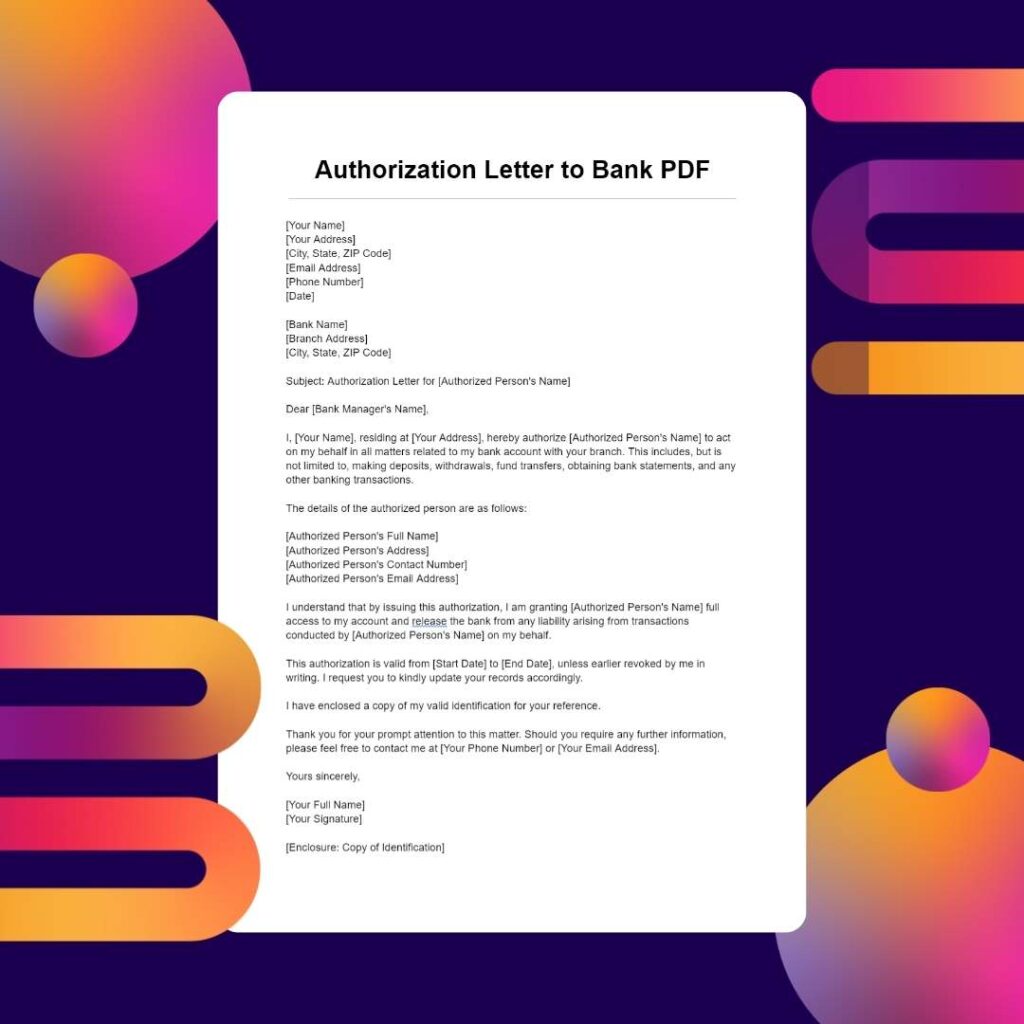

Authorization Letter to Bank PDF

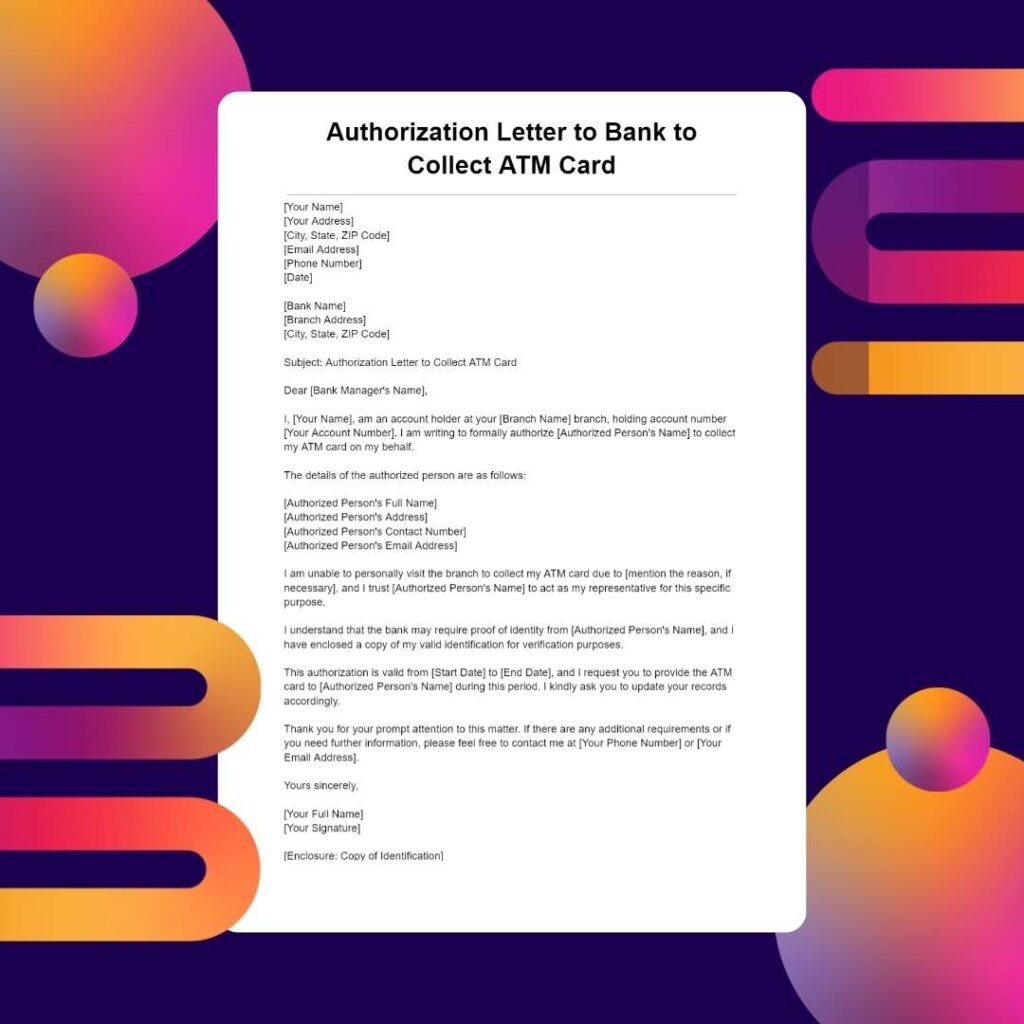

Authorization Letter to Bank to Collect ATM Card

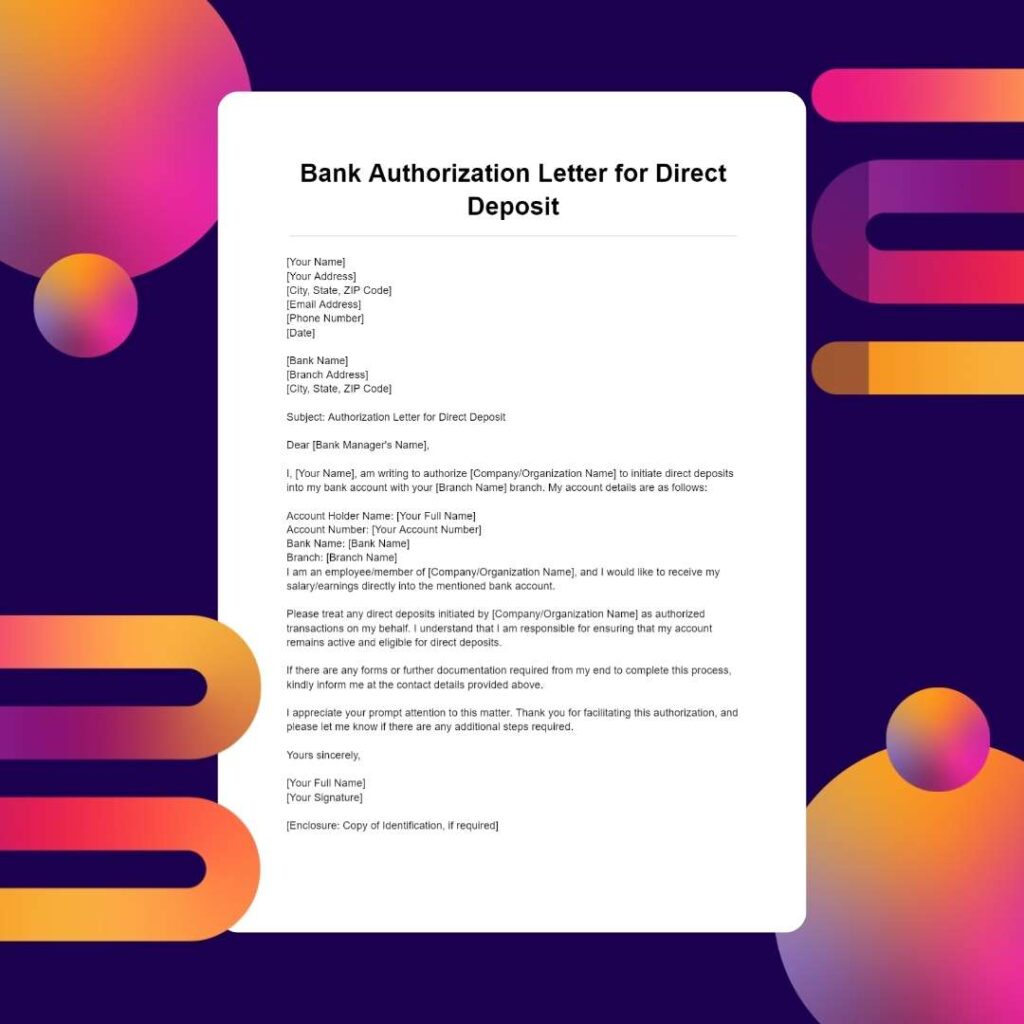

Bank Authorization Letter for Direct Deposit

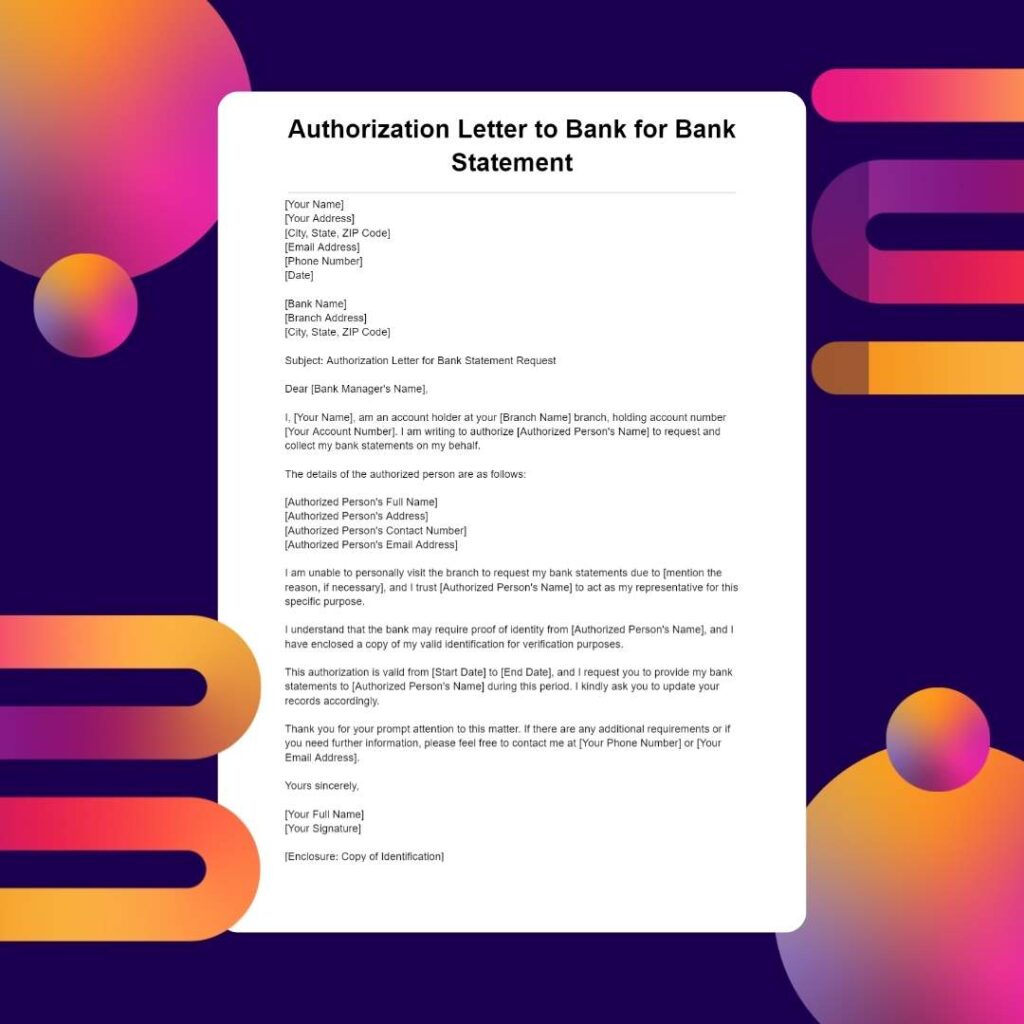

Authorization Letter to Bank for Bank Statement

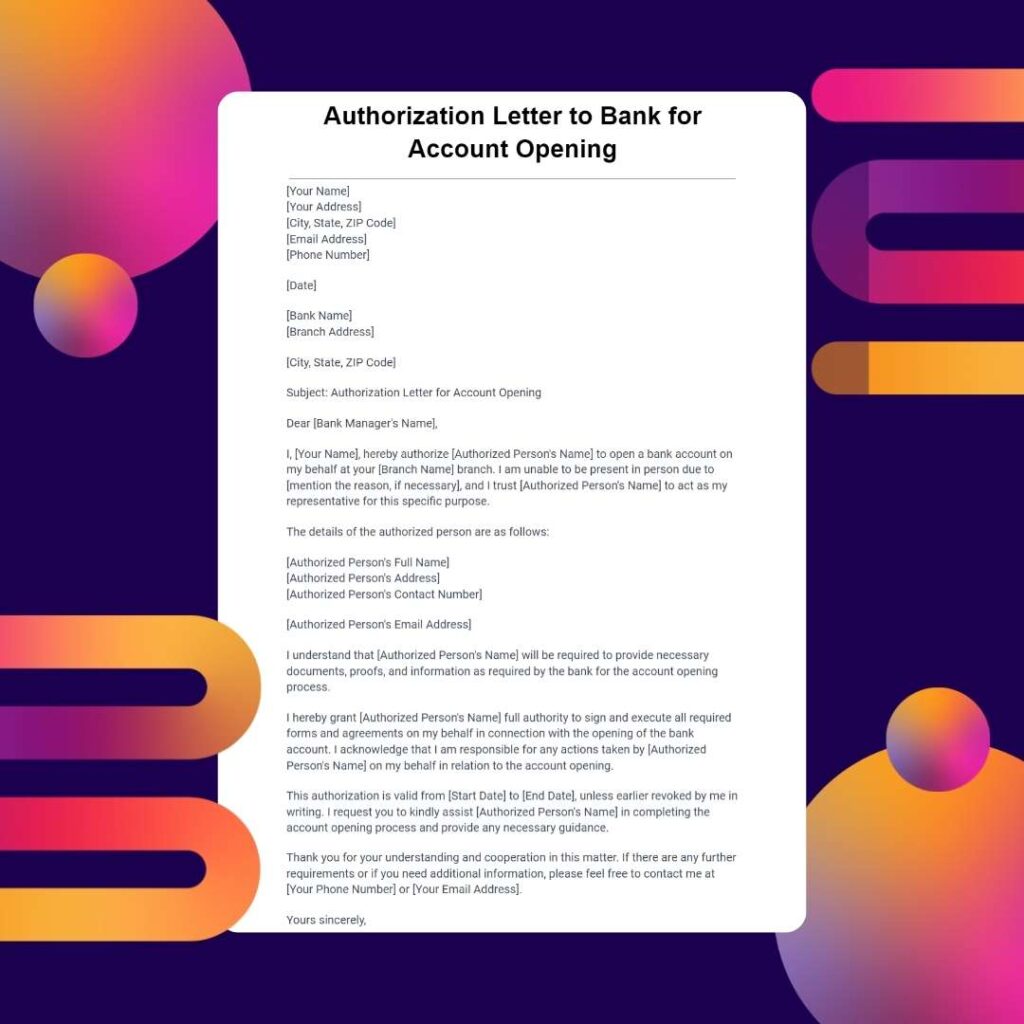

Authorization Letter to Bank for Account Opening

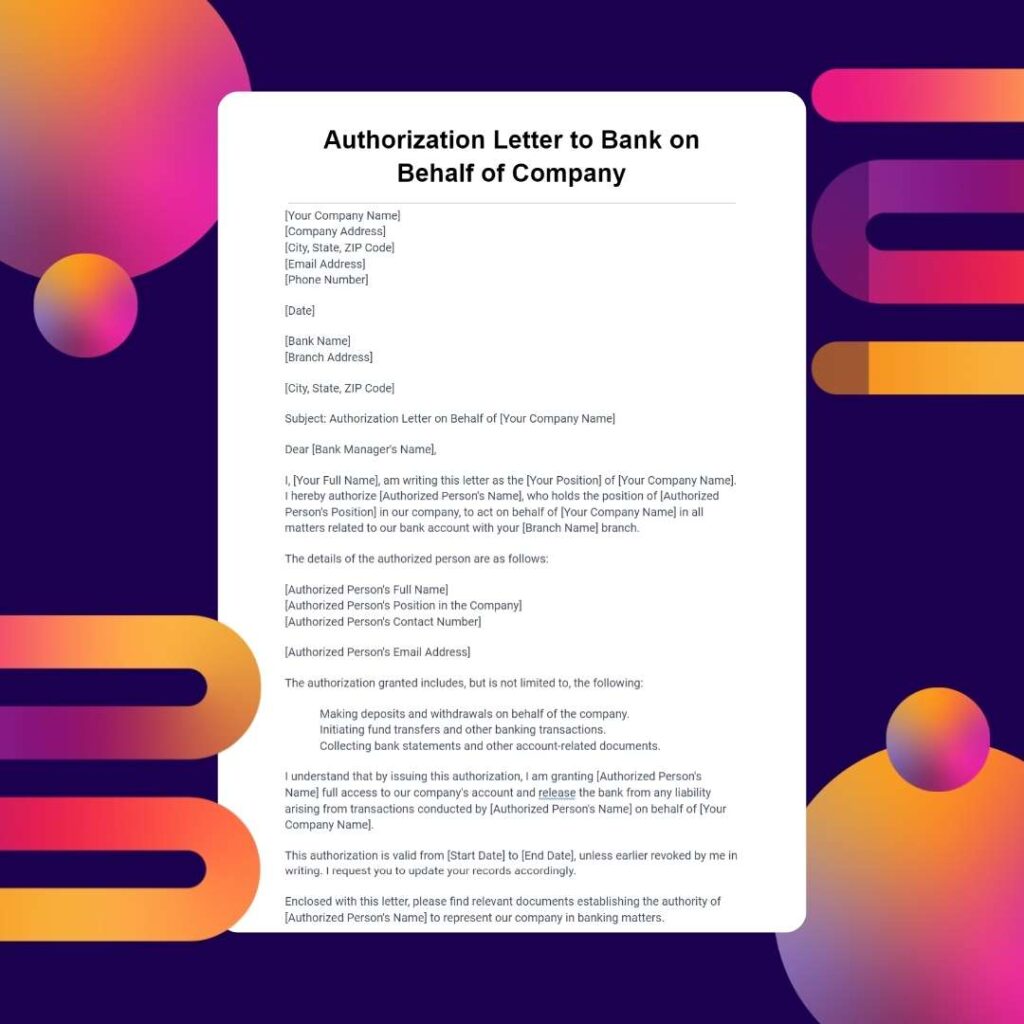

Authorization Letter to Bank on Behalf of Company

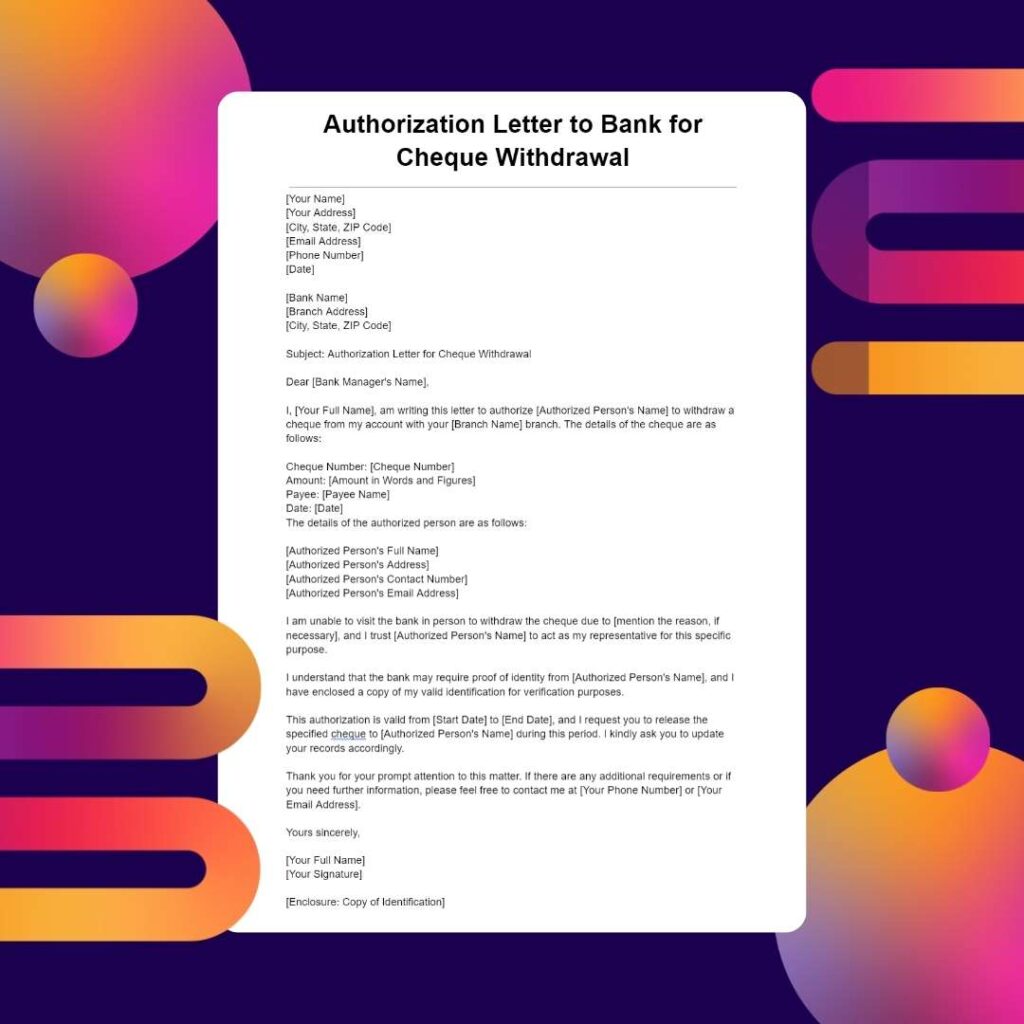

Authorization Letter to Bank for Cheque Withdrawal

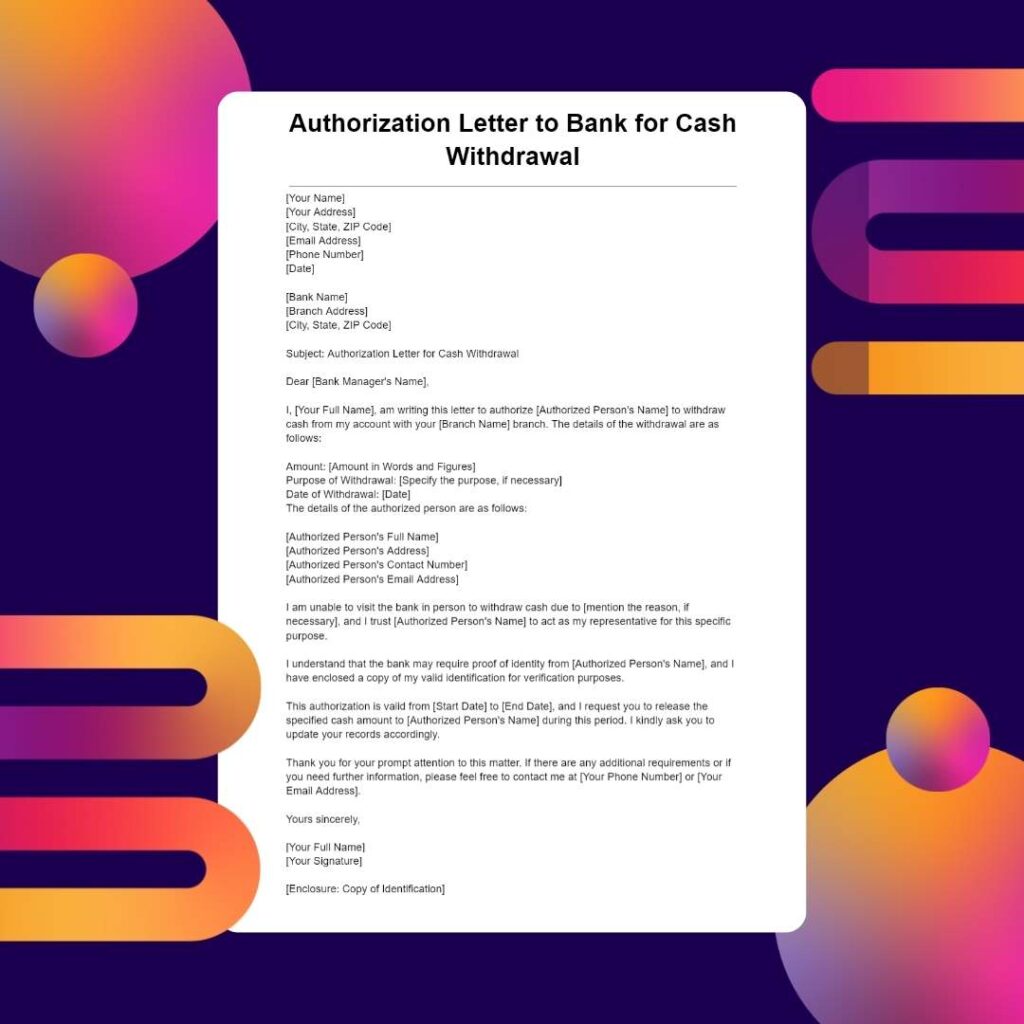

Authorization Letter to Bank for Cash Withdrawal

Recap of the Importance of Bank Authorization Letters

In the intricate landscape of banking, the importance of Authorization Letters cannot be overstated. These formal documents serve as guardians of legality, security, and accountability in financial transactions. By encapsulating the account holder’s consent, Authorization Letters navigate the regulatory complexities, contributing to a robust and transparent banking system.

Legal Safeguard:

Authorization Letters provide a legal safeguard, ensuring that all actions taken on behalf of the account holder are well within the confines of the law. This not only protects the account holder but also aids banking institutions in complying with regulatory requirements.

Security Enhancement:

Acting as gatekeepers, Authorization Letters enhance security measures by verifying the identity of those seeking access to sensitive financial information. This layer of authentication is vital in preventing unauthorized access and potential fraudulent activities.

Privacy Assurance:

By explicitly delineating the scope of authorization, these letters safeguard the privacy and confidentiality of an account holder’s financial details. This is paramount in an era where privacy concerns are at the forefront of financial transactions.

Risk Mitigation:

Authorization Letters mitigate risks by establishing clear expectations between the account holder and the authorized party. This reduces the likelihood of disputes, misunderstandings, or unintended consequences arising from financial transactions.

Final Thoughts on Crafting Effective Authorization Letters

As individuals navigate the nuances of crafting Authorization Letters, a few key considerations can significantly enhance the effectiveness of these documents.

Clarity and Specificity:

Be explicit and specific in outlining the actions or transactions being authorized. Clarity eliminates ambiguity and ensures that the letter serves its intended purpose.

Formal Language and Professional Tone:

Maintain a formal tone throughout the letter. Use professional language to convey the seriousness and legality of the authorization, fostering a sense of trust and reliability.

Attention to Detail:

Pay meticulous attention to details, including names, addresses, and identification information. Accurate details contribute to the validity and acceptance of the Authorization Letter by the banking institution.

Adherence to Bank Policies:

Familiarize yourself with the specific policies and requirements of the bank. Ensure that the Authorization Letter aligns with the bank’s protocols to avoid any unnecessary delays or complications.

In conclusion, crafting an effective Authorization Letter is not merely a procedural formality but a crucial step in ensuring the smooth execution of financial transactions. Whether delegating authority or seeking permission, individuals can navigate the intricacies of banking with confidence by adhering to best practices in Authorization Letter composition. As guardians of legal compliance and security, these letters play a pivotal role in fostering a trustworthy and secure financial environment.